Our relationship with money, undoubtedly, serves as one of the most defining relationships of our lives.

Whether we hoard it, overspend it, worry about it, chase it, save it, or give it all away, the way we interact and think about money affects countless aspects of our lives.

Some consider money as merely a tool. And that is true, money is a tool.

But it is also much more than that. One must only look at the fact that 77% of people in the richest nation in the world remain anxious about their financial situation to see that money is treated differently in our mind and heart.

And considering that more than 70% of Americans report their desire for money influences their daily decisions, I would again argue stands as proof that money is no ordinary tool. How many people do you know base their daily decisions on passionately acquiring more tools?

Money has a much deeper impact on our lives and psyche than a tool. And we can see it all around us—and inside us.

Therefore, to understand ourselves better and conduct ourselves best, it is essential that we constantly evaluate the role and importance we place on money in our mind and in our heart.

To help, I want to introduce you to a phenomenon concerning money that plays out in a large majority of people’s lives—probably yours and almost certainly mine.

The phenomenon is what I call: The Prosperity Paradox.

This paradox about financial wealth can be summarized this way: The more money we accumulate, the more money we think we need.

And it’s one of the reasons 80% of Americans think they would be happier if they had more money.

Rather than providing happiness and security as many people think it will, money seems to have an opposite effect. The more we have, the more we think we need.

A bold statement, no doubt. One that you probably want to immediately disagree with. But this paradox is not merely a philosophical musing; it is underscored by compelling research and statistics. Let me offer you four studies that clearly display the prosperity paradox in action.

Individuals were recently asked how much money they believed they would need to retire comfortably. The average response was $1.46 million. Numerous articles were written about how that number has increased over recent years.

But read further into the study and you’ll discover a fascinating fact. According to the study, the higher your net worth, the more money you believe you need to retire. In fact, while the average American believes they need $1.46 million to retire comfortably, high-net-worth individuals (people with more than $1 million in investable assets) said they’ll need nearly $4 million to retire comfortably.

The Prosperity Paradox: The more money a person has, the more money they think they need to live a comfortable life.

Here’s another study less focused on the future and more focused on the here and now. Again, we see the same thing happening.

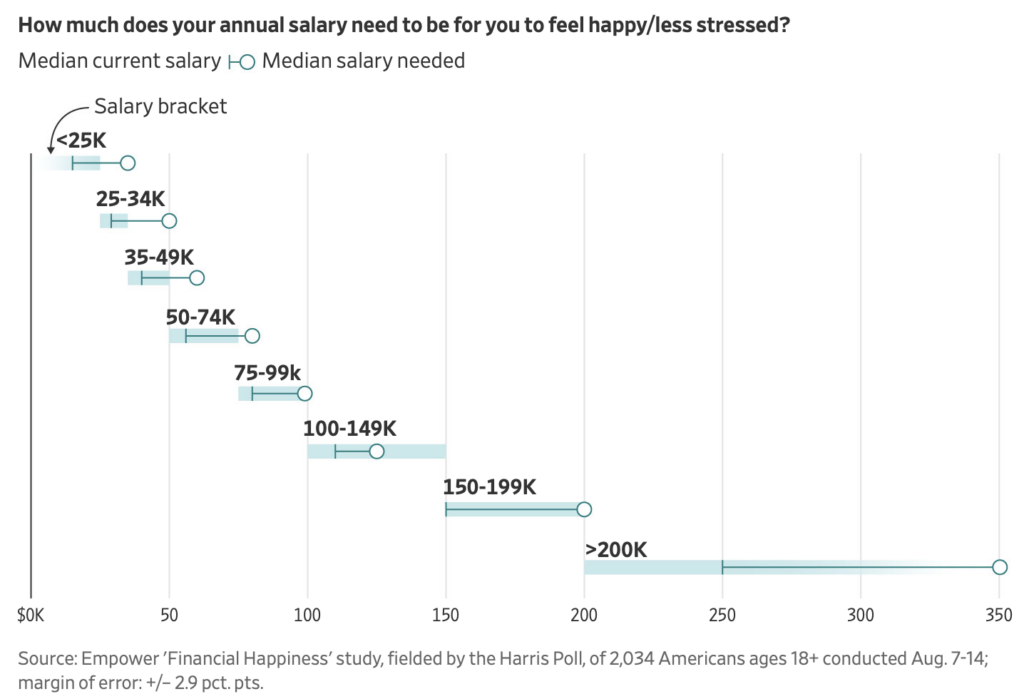

The financial services company, Empower, recently asked people, “How much does your annual salary need to be for you to feel happy or less stressed?”

The median answer to the question was “an additional $30,000/year would result in happiness.” But among the highest earners (those already making more than $200,000/year), they responded that they would need an additional $150,000/year to be happy!

The income brackets align exactly with what the Prosperity Paradox would predict. Across the income brackets, the more money a person makes, the higher the pay increase they said would result in happiness.

You can see the exact breakdown here:

We can also see the paradox in play as to how people define rich.

To many, a millionaire embodies the epitome of financial security. In fact, your specific answer to the question, “Is a millionaire wealthy?” likely reveals quite a bit about your current financial circumstance.

Is a millionaire wealthy?

Did you answer the question, “Yes”? If so, chances are, you don’t have a million dollars. Because the closer you get to that level of net worth, the less likely you are to consider it rich.

In fact, millionaires comprise about 8.8% of the American population. And yet, an astonishing 87% of millionaires do not view themselves as wealthy.

90% of those living in the top 10% of the wealthiest nation of the world do not consider themselves wealthy. How can this be?

Only when you understand the Prosperity Paradox does this self-identification begin to make sense. The more money a person has, the more money they require to feel wealthy. The goal posts of wealth just keep moving further and further away.

But it’s not necessary to only point fingers at millionaires. Did you know that if your net income is $65,000/year, you are among the top 20% of wage earners in the world today?

That’s right, $65,000/year earns you more money than 80% of the planet.

You can run your own numbers here: World Inequality Database.

Is that how you feel earning $65,000/year? Among the very wealthiest in the world? Probably not. Because the Prosperity Paradox rears its ugly head at nearly every income level.

No wonder John D. Rockefeller, the richest man in the world at that time, when asked by a reporter, “How much money is enough?” responded by saying, “Just a little bit more.”

That is the nature of money. It never satisfies. It never brings the happiness we believe it will. It never brings lasting security. Nor does it bring the contentment we desire.

“How much money is enough?” is a question very few people can answer. Except with the response, “Just a little bit more than I have now.”

Be aware. If that is your belief, you will never arrive.